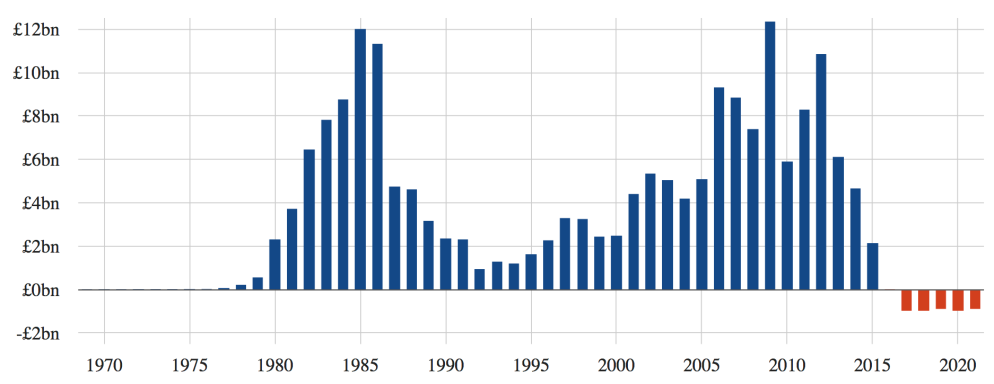

(c) carbonbrief.org (Shell payments to the UK)

NOTE: I’m reposting this in the light of the news today from the Business for Scotland reported in the Sunday Herald:

According to Goldman Sachs, in Oil and Gas People:

‘Oil majors are raking in more cash now than they did in the heyday of $100 oil, according to Goldman Sachs Group Inc. Integrated giants like BP Plc and Royal Dutch Shell Plc have adapted to lower prices by cutting costs and improving operations, analysts at the bank including Michele Della Vigna said in a research note Wednesday. European majors made more cash during the first half of this year, when Brent averaged $52/bbl, than they did in the first half of 2014 when prices were $109.’

Why then are we not hearing of a flow of revenue to the UK treasury in 2017, as we did of the single year of losses in 2016? I think the answer is simple. They’re not being taxed and the Unionist media are not interested. Indeed, they’re often being subsidised. See this from ‘The UK’s North Sea oil revenues: Giving it away?’, August 2016 report, from taxjustice.net:

‘New analysis of the UK’s North Sea oil and gas suggests that the combination of tax giveaways by the government, and aggressive avoidance by multinationals, means that the country may actually be subsidising the extraction of its natural resources. A new report published today by the International Transport Workers’ Federation (ITF) sets out a series of shocking statistics on the UK’s failure to obtain an appropriate share of its own resource wealth. Among them, these stand out:

- In 2014, UK consumers paid 6 times more tax on petrol, excluding VAT, than the North Sea oil and gas industry paid on all taxes related to production.

- Chevron’s effective tax rate in 2014 on earnings from North Sea production was 5.4%; statutory tax rates (of various types) on oil and gas should have totalled 61-82%.

- In 2014, 3 (Shell, BP & Total) of the top 4 North Sea producers produced more than £4.3 billion worth of oil and gas and received over £300 million in net tax refunds.

The ITF argue that while the oil sector has successfully lobbied for and won huge tax breaks from the UK government, the companies involved continued to pursue aggressive tax avoidance as standard practice. The Chevron report (see graphic for UK structure, click to enlarge) provides a detailed case study of tax dodging tactics which are replicated by others, particularly Nexen – on which the Times had a frontpage splash yesterday, using ITF analysis to show that the Chinese government-backed company received tax credits of £2 billion.’

http://www.taxjustice.net/2016/08/25/uks-north-sea-oil-revenues-giving-away/

Now remember, prices were still relatively high in 2014. It seems a little paranoid to think the UK government would have allowed this to destroy the case for Scottish independence based on oil wealth but not impossible. I suppose there are other reasons which are more subtle in the form of the effects of interlocking elites so well described by Noam Chomsky. Those at the top in the corporations, in the media, in the financial world, in the academic economics professoriate, in the civil service and of course in the Conservative party have shared interests, shared social and educational backgrounds and so acting in their own interests they act in the interests of the corporations. There’s an obvious parallel in the aggressive pursuit of benefit fraud and the cosy deals done with corporate tax avoiders. Either way, Scottish North Sea oil is highly profitable, it’s not being taxed and we’re not hearing of this in the Unionist media. Don’t think the Chinese (Chevron) case spoils the theory. The Chinese elite is being educated by us! See:

Am I paranoid? Here are Shell’s payments in 2015. Look at the Norway figure!

Reblogged this on sideshowtog.

LikeLiked by 1 person

Thanks

LikeLike

John,

It gets worse!

In the third paragraph from the end of the Goldman report it states “That will give companies the ability to stop paying dividends by issuing new stock, which has diluted major European energy shares by 3% to 13% since 2014.”

Isn’t this what the Americans call a “Ponz Scheme”?

LikeLike

Correction – It’s a “Ponzi Scheme”.

LikeLike

Hadn’t thought of that.

a form of fraud in which belief in the success of a non-existent enterprise is fostered by the payment of quick returns to the first investors from money invested by later investors.

LikeLike

Dear Speymouth

Howabout not just copying my whole article to your site so that readers have to come to mine for the full thing and I get a better notion of readership?

John

LikeLike

This is shocking! Even when you assume that they are all at it,,, well, I’m speechless. Westminster is bleeding us dry, in more ways than one. With impunity. (Not QUITE speechless, but relatively speaking)

LikeLike

Like a figure of speech?

LikeLike